It’s the middle of June. Do you know where your Realtor is?

One of the best things about being a real estate agent is making your own hours. The other thing is is that real estate is very cyclical and that means that business slows down in the summer and around holidays. What better combination could you have?

Rates to remain high

Bank of Canada deputy governor Paul Beaudry stated that due to the persistent strength in the economy, interest rates may need to remain higher for a longer period to control inflation. The decision to raise the policy rate by a quarter-point in June was influenced by economic data since the April decision to keep rates unchanged. Beaudry emphasized that the evidence from various economic indicators suggests that excess demand in the Canadian economy is more lasting than previously thought, increasing the risk of inflation not declining as expected. He advised Canadians to prepare for a prolonged period of higher interest rates in order to alleviate cost pressures and achieve the Bank of Canada’s two percent inflation target. Beaudry also warned about the consequences of inadequate planning in the face of higher rates, citing recent issues in the global banking sector as an example.

The Canadian housing market continues to thrive

In 2022, there was a brief period where it seemed like the overinflated housing market in Canada was correcting itself. However, the price drops slowed down, making homeownership unattainable for many. Real estate publications hailed this as a return to “normalcy,” despite the continued detachment of housing prices from local economic conditions. Just a year later, despite the central bank raising interest rates, real estate professionals are confident that the housing market will continue to thrive. The situation is largely influenced by government policies that support high real estate prices, leading to what is known as the Great Canadian Housing Bailout.

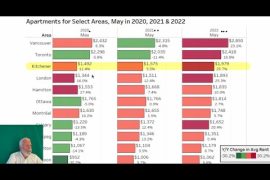

A significant number of Canadians have given up hope of owning a home, with a record 63 percent of non-homeowners expressing this sentiment in a recent poll. The average price of a Canadian home has soared to $716,000, almost three times higher than in 2000 even after adjusting for inflation. Surprisingly, when the federal budget was presented in March 2023, it did not include any policies aimed at increasing the housing supply.