The combination of covid lockdown, a typical January lack of listings and an historically low level of inventory this year made January 2021 unique in many ways.

Predictions for the 2021 real estate market

Buyers will continue to face strong competition due to pent up demand and shortage of inventory.

Condo market rents will rebound.

Mortgage rates will remain historically low.

No new mortgage regulations will be introduced in 2021.

Old school realtor tactics will fade as realtors aim to become strategic partners.

Realtors will adopt digital market methods — Youtube, chat widgets, blogs…

Open houses and unnecessary viewings will decline as real estate goes virtual.

Working from home will remain popular post-covid.

Larger home will continue to be in high demand

Larger luxury home market will continue to outpace supply

Confidence in real estate is predicted to remain strong

Move-up buyers will continue to dominate the market

Prices will rise (16% in Ontario)…

RECORD-BREAKING HOME SALES IN DECEMBER CAPS OFF AN EXCEPTIONAL 2020

There were 6,492 residential homes sold in 2020, an increase of 9% compared to 2019.

Compared to previous years, 2020’s annual sales were 5% above the previous 5-year average, and 11.6% above the previous 10-year average.

On a monthly basis, there were 42% more home sales compared to last year, with 351 home sales in the month of December…

Canadian condo apartment prices are forecast to underperform next year.

A typical condo in Canada will cost $522,700 in 2021, up 2.25% from the year before.

This is about half the growth they’ve forecast for the total of all home types.

All segments of Canada’s real estate market are forecast to see price growth slow this year.

But notably for condos, people are moving away from city centers.

This trend began before the pandemic, and it was accelerated by low mortgage rates and work from home adoption.

This trend takes people away from prime condo markets, and mostly puts them in other home types.

3 Reasons To Consider Buying A Home In January

It may be a seller’s market, but during the month of January, buyers have the advantage.

Three reasons to consider buying this month.

Holiday Debt Lowers The Competition

No One Wants To Move In The Winter… Except Those That Have To

Sellers Tend To Be A Little More Desperate Around This Time Of Year

What’s happening with 2-bedroom freehold townhouses in Kitchener?

How’s the market

In this episode of “How’s the market?” I look back at 2020, especially the last four months of 2020 to show how we got here. Essentially early January + Lockdown = Lack of supply of homes available for sale.

And if the lockdown ends at the January or at the end of February, I predict a crazy spring market.

This is a monthly report. I do one mid-month every month so, subscribe!

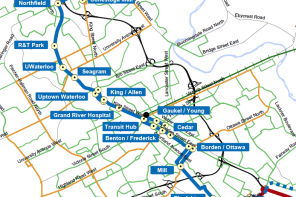

Kitchener-Waterloo Real Estate 7-Day Market Update

Brought to you by Kitchener-Waterloo Real Estate News Keith Marshall, Realtor

New listings: 80

Homes sold: 81

Conditional Sales: 16

Average days on market: 15

Median days on market: 7

Average list price: $553,963

Average close price: $641,241

Average SP/LP: 116.55%

Median list price: $549,000

Median close price: $650,100

Median SP/LP: 116.68%

How to Save Money When Buying a Pre-construction Home or Condo

1. Go to the presentation centre with a Realtor representing your best interests.

2 Negotiate Closing Costs.

3 Cap Development Charges and Levies.

4 Remove other fees…

If you are interested in real estate news and statistics, here is the link to my other site — kwrealestatenews.com