There is no need to fear a housing crash, on the contrary…

Predictions are often wrong

Early in the pandemic, the predictions were that it would take the real estate market 18 months to recover from the shock of Covid-19.

Wrong!

Rule #23: Predictions are often wrong.

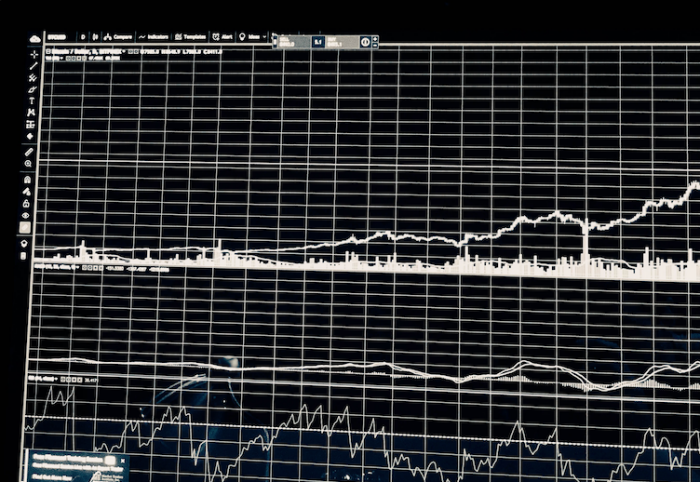

You can look at any plotted graph of local sales activity and clearly see a sudden drop in April and then a fast climb back onto the trajectory line of where we were going.

And, we continue on that line now, out of the late summer, into Autumn. Early in the summer, prices (and life) stabilized and here in Kitchener-Waterloo we re-started breaking records one more time again. It took three months to continue what started at the beginning of 2020 and as we enter the Autumn market, there appears to be no end in sight.

Special Update: 2021 Predictions

Predictions for an 18% decline?

Of course, just like every other time the market starts careening out of control, the talk of an impending crash starts to bubble up. Don’t get me wrong. The market could get overheated, catch on fire and fall back to earth, a flaming wreck. There was a story a few weeks ago with a prediction of an 18% decline in home prices.

Thank you CHMC for those dire predictions.

Anything could conceivably happen.

But I wouldn’t bet on that! I’d bet against that.

How’s the market?

Let’s talk briefly about the market

The real estate market is like a farmers market – there are lots of independent markets. These independent markets have very little impact on each other. We might get a media report about how rents have fallen in Toronto over the past eight months or how the AirBnb market dried up, impacting the number of downtown Toronto condos for sale. Reading these news stories we might think this is the beginning of the end.

But at the same time, we see that locally, our absorption rate has fallen again to one month’s supply of homes available to buy or that the average price of a single family home has just busted through another high water mark.

What’s the trend?

What lies ahead?

Will the market crash or will it continue to rise?

Bull market predictions

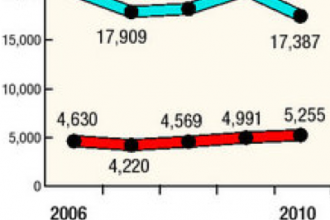

As a Realtor I’ve been through economic uncertainties before. I was here for the great recession (’07-’09). Since then, house prices have more than doubled.

Here’s why house prices will not drop in 2020 (and probably beyond).

Five reasons house prices will not drop in 2020

Interest rates

If you go back in time to last time our housing prices dropped, you will have to go back to the early 1990s. Back then interest rates not only hit double digits, they went as high as 15%! That is not going to happen this time. On the contrary, the Bank of Canada predicts that it will not raise interest rates before 2022.

Unemployment

Again, back in the early 1990s, back when we were wearing neon and fluorescent warm up clothing, or grunge inspired flannel, Birkenstocks and organic cotton, the unemployment rate was over 10%.

Although our current unemployment rate is much the same, the make up of the unemployed is not. Jobs in retail, hospitality, travel got wiped out by Coronavirus, not jobs in manufacturing, skilled trades and middle management, as was the case in the 1990s.

Equity

On the whole, we are older, wiser and richer than we were in 1990. Back then, the Zoomers were still Boomers. Back then we didn’t have the cushion to ride out an economic shock, especially one that doubled our mortgage payments. Homeowners today have much more equity in our homes and in our savings. If things get bad, we don’t have to sell.

Economy

Canada has a much different economy than we had last time the market crashed. We are no longer so reliant on natural resources and manufacturing. Free trade and immigration (next point) were nowhere near the levels that they are today. A 1990s-style housing meltdown cannot happen, at least not with the same players, factors and influences.

Immigration

Immigration has been a driving force in the Canadian economy (and our housing market) over the past several years. A lot of immigration is into Canada’s biggest cities, and here in Kitchener-Waterloo we are impacted directly (and indirectly with the spillover effect) — I’ve helped new Canadians from everywhere from Oman to Taiwan, from Equator to Singapore buy homes in Kitchener-Waterloo.

I’m sure immigration is down this year and that hurts. But our standing in the world as a safe and stable place to work, study and live has not been tarnished by the pandemic. Statistics show that new immigrants to Canada wait three years on average before buying their first home. With that in mind, the impact of low immigration into Canada during Covid will not be felt for a few years to come, if ever.

Further study:

Predictions for the 2020 real estate market

26 reasons for the housing shortage in Kitchener-Waterloo

Kitchener-Waterloo Real Estate News