Buying a home can be a long (but interesting and exciting) process. When you near the end of the process, you will be required to pay closing costs, which are the legal and administrative costs in order to complete the contract and get the keys.

As a general rule, closing costs range from 1% to 2% of the selling price.

Closing costs covered by the home buyer include:

Land Transfer Tax

This is calculated, like income tax, on a graduated scale. There are lots of LTT calculators online. Here is one.

Legal Fees and Disbursements

Your real estate lawyer will charge you about $900 to prepare and record the official documents.

Title Insurance

In the old days we did title searches and property surveys to ensure there were no disputes against the property. Since about the year 2000 lenders require title insurance. It costs roughly $500.

Other costs for the homebuyer

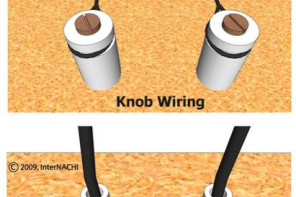

Home inspection

If you are going to do a home inspections (you should), expect to pay between $350 and $450. Some inspection companies now offer home warrantees. Expect to pay near $1000 for those.

Deposit

The deposit is required with the offer or once the offer is accepted. In Kitchener Waterloo it tends to be 1%-2% of list price. Once the conditions are removed and the deal becomes firm, the deposit is considered to be a down payment. If the conditions are not met, then the deposit is returned in full to the buyer.

CMHC insurance

If you are putting less than 20% down payment on the purchase of your new home, you are required to get mortgage default insurance.

Real estate agent commission

Homebuyers are not expected to pay their realtor for his services. Your realtor gets paid by the listing brokerage. That is a sweet deal for homebuyers. Of course we know that eventually you will sell and then you will have to pay commission.

1-2% downpayment? Isn’t it actually more like 10% – 20%

Closing costs tend to be 1% to 2% of the home’s purchase price. For example in Kitchener-Waterloo the average home sells for about $500K, which means you should budget $5000 to $10,000 for lawyer fees…

Down payments are typically 5% to 20% of purchase price and are not considered part of closing costs.