Last week I helped a couple of clients lease a commercial building. One thing lead to another and those lead to looking for free credit reports.

Last week I helped a couple of clients lease a commercial building. One thing lead to another and those lead to looking for free credit reports.

We’d been looking for the right spot for their office for some time and just like searching for a new family home, we figured out what exactly we wanted and after narrowing down the search to three possible places, put in an offer to lease on the favourite.

Part of the agreement to lease was that the landlord could request a credit report on my clients.

The landlord then said, “If I do it, it will appear as an inquiry on your report. But if you do it it’s free and easy and does not appear as an inquiry.”

It’s is widely believed that too many inquires on a credit report is bad for your credit. That’s not exactly true. But, my clients agreed to pull their own reports and give them to their new landlord.

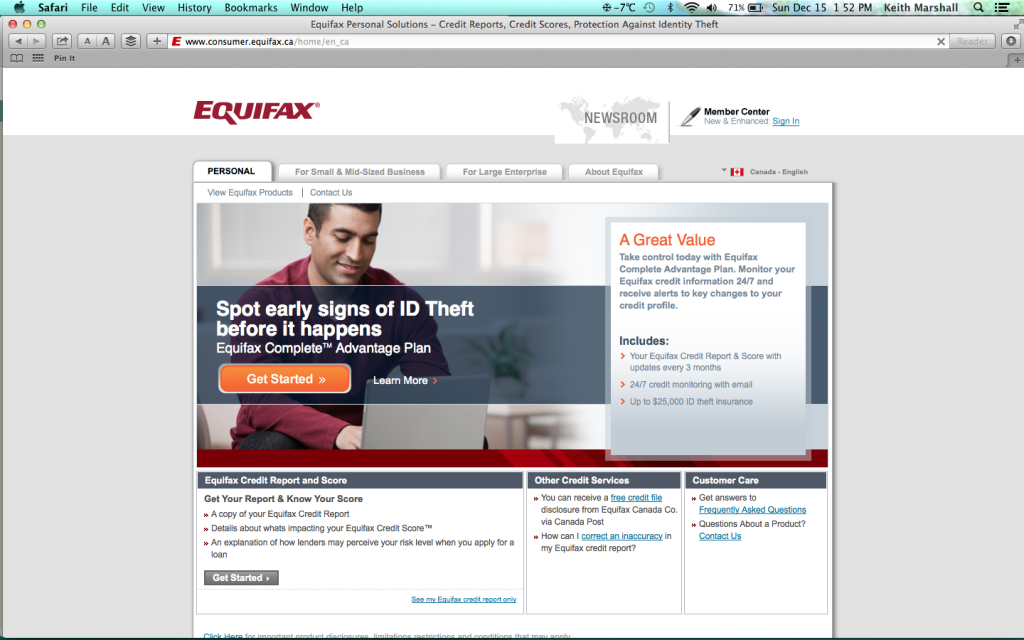

Equifax

They may not do it on purpose, (I think they do), but it is not really obvious where to click. There are a couple of places my clients clicked that did not lead to a FREE credit report. Tell me? Where would you click? Is Equifax trying to lead us to a paid credit report?

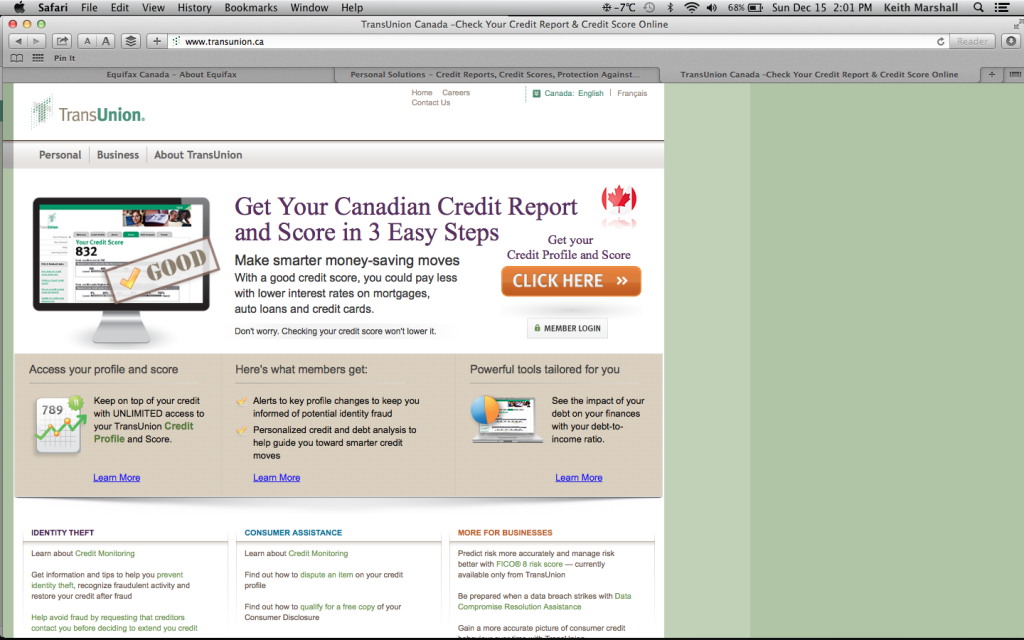

TransUnion

TransUnion’s site looks like this. Again, it’s not obvious where to click. The most obvious place leads you to a paid options. Where would you click? Is TransUnion intentionally making the free consumer report hard to find?

What is in my credit report?

Credit reports may contain:

Identifying information: name, current and previous addresses, Social Insurance Number, telephone number, date of birth, current and previous employers

Credit history: history of bill and debt payments

Public records: judgments, and bankruptcies

Inquiries: a list of credit grantors and other parties authorized by the consumer and/or by law, which have received a consumer’s credit report

Other information: banking information and/or collections

Credit reports do not contain:

Medical history

Purchases paid cash or cheques

Business/Personal accounts, unless you are personally liable for the debt

Race, creed, colour, ancestry, ethnicity or political affiliations

Income

Criminal records, traffic violations

How do I establish a good credit history?

Establishing a good credit history takes time. If you have steady income and have used the same mailing address for at least one year, you may wish to apply for credit with a local business or department store or for a secured loan or credit card through a financial institution. Paying credit obligations on time will help you develop a good credit history and may enable you to obtain additional credit in the future.

When you apply for credit, you may wish to see if the company reports account information to a credit-reporting agency. Companies are not required to report account information but most do.

If you are declined credit, find out why. You may be have been declined for various reasons including your not having met with the creditors minimal income requirement or not having been at your current residence or job for the required amount of time. You can overcome these obstacles with time.

If you have problems establishing credit, you may wish to ask a person with established credit to co-sign an application for you. This allows the creditor to base the decision on both applicants’ credit histories. Please note that a signer and co-signer are equally responsible for repayment of the debt. Payment history on this type of debt may be reflected on both parties’ credit reports. Once timely payments have been made on the account, you may again wish to apply for individual credit.

Each creditor has different requirements for issuing credit. If you are declined credit, contact the creditor to determine the reason for the decline.

When filling out credit applications, it is important to use complete and accurate personal information.

Fixing your credit score is much more difficult than maintaining it. If you have a black mark on your credit history, it can take (six) years to drop off.

Here’s what you should do once you have established (good) credit:

1) Pay all of your bills on time.

2) Do not get sent to collections.

3) Do not spend up to your credit limit. Keep your account balances below 75% of your credit limit.

4) Do not apply for (more) credit unless you really need it. Inquiries appear on your credit file and may be seen as an attempt to take on more debt than you can afford

What negatively impacts your credit score?

Serious delinquency

Serious delinquency, and public record or collection field

Time since delinquency is too recent or unknown

Level of delinquency on accounts is too high

Number of accounts with delinquency is too high

Amount owed too high on accounts

Ratio of balances to credit limits on revolving accounts is too high

Length of time accounts has been established is too short

Too many accounts with balances

What about a bad debt?

How long does a delinquency stay on my account?

The information will stay on your report for six years from the time of delinquency.

Source one: Equifax

Source two: TransUnion

Photo: credit